Platforms in Digital Health: 2021 Market Report

Updated: Mar 15

Nick Webber and Seth Joseph

Seeing incredible funding increases and growing prominence in healthcare, digital health platforms continue to dominate the industry in 2021, growing faster, scaling quicker, and receiving higher valuations than their non-platform counterparts. Request the full report here.

The Untold Story—and Incredible Opportunity—of Digital Health Platforms

2021 saw another banner year for investments in digital health. Total funding among US-based digital health startups reached a whopping $29.1B in 2021, or nearly double the level of investment from the record-breaking year prior ($14.9B in 2020), according to Rock Health’s annual funding report.

For the healthcare industry to see this level of activity, interest, and investment in digital health’s continued disruption of healthcare delivery is a trend worth highlighting in and of itself.

But there is an untold story here; a less discussed and underreported part that is arguably the most compelling story of all: digital health platforms are positioned to become the dominant business model, growth driver, and enabler of healthcare industry change now and in the future.

In Summit Health’s second annual Platforms in Digital Health: 2021 Market Report. Building on last year’s analysis, the Platforms in Digital Health: 2021 Market Report:

Breaks down the digital health platform funding landscape;

Provides timely data and insights on how digital health platforms are evolving and the growth trajectory of the investment landscape;

Offers key takeaways and guidance for both investors and digital health platform developers looking for the highest returns, growth potential, and business impact.

For the purposes of this report, digital health platforms include all multisided platforms and marketplaces that utilize technology to connect and/or facilitate a transaction between previously disparate healthcare constituents.

By understanding how digital health platforms grow and scale—and the requirements for success—platform founders, investors, and potential partners can solve critical problems in healthcare and chart a course toward both operational and financial success.

🔥 Hot take: “Know that many people you’ll encounter either through hiring or fundraising or seeking coaching will be highly experienced and successful people, but very few will have platform experience. Be sure to set expectations early with those folks that your business will function differently than they are used to, and make sure they are open-minded to that.” — James Lloyd, Cofounder and CTO, Redox

Digital Health Platforms Command Record-Breaking Levels of Investment, Continue to Outpace Growth of Non-Platforms

Platforms represent the fastest-growing business model among U.S. digital health investments today, outpacing their non-platform counterparts and seeing impressive year-over-year growth acceleration. Specifically, Summit Health’s analysis shows:

Investments in digital health platforms have exploded, with no signs of slowing down:

> Investment in digital health platforms in 2021 ($11.8B) alone outpaced all digital health investments (platforms and non-platforms) in 2019 ($8B).

> Investment in digital health platforms increased ~1,900% between 2017 - 2021, while investments in non-platforms grew 320% during the same time period.

> The rate of funding growth for digital health platforms is increasing, from 72% year-over-year (YOY) growth in 2020 to 183% growth in 2021

> The rate of funding growth has been decelerating for digital health non-platforms, decreasing from 93% YOY growth in 2020 to a still impressive 60% YOY growth in 2021

Platforms accounted for 4 of the top ten digital health deals in 2021: Honor, Commure, Collective Health, and SonderMind were four of the top 10 deals in all of digital health. Collectively, the top 10 digital health platform deals accounted for $2.25B in capital, which represents a 50% increase between 2020 and 2021.

The deals are bigger, and there are more of them: There were 66% more $100M+ platform deals in 2021 than 2017-2020 combined, and 3X more deals in digital health in 2021 than 2020.

Digital health platforms that demonstrate the ‘flywheel effect’ command a valuation premium: Platforms receive a valuation premium (versus non-platform peers) that grows over time, reaching a 2.8X premium versus their non-platform peers by the time they raise capital for a Series D and beyond.

Additionally, one-third of the companies included in the 2021 iteration of CBInsights’ Digital Health 150 report are platform companies.

💡 Pro tip: “It’s all about achieving critical mass among customers, developers, and Marketplace partners. It starts with the customer base. That has to come first.” — Abhinav Shashank, CEO, Innovaccer

Valuation Darlings: Digital Health Platforms Reign Supreme for Growth, Scalability, and Profitability

Among the reasons that digital health platforms and marketplaces are getting funded is due to the mechanism of value creation. By connecting different constituents and allowing them to transact efficiently on a common technology infrastructure, digital health platforms are able to address many of the most complex challenges facing our fragmented healthcare systems (see image below).

As early-stage digital health platforms start to demonstrate real market traction, investors recognize the flywheel potential, and platforms start to realize a valuation premium compared to their peers, which increases from 1.8X ($227M vs $125M) in Series C to 2.8X ($850M to $300M) in Series D and beyond.

The valuation premium is explained by network effects, which serve to increase the value and stickiness of the platform for its users, raise barriers to entry, and ability to drive increasing financial returns to scale.

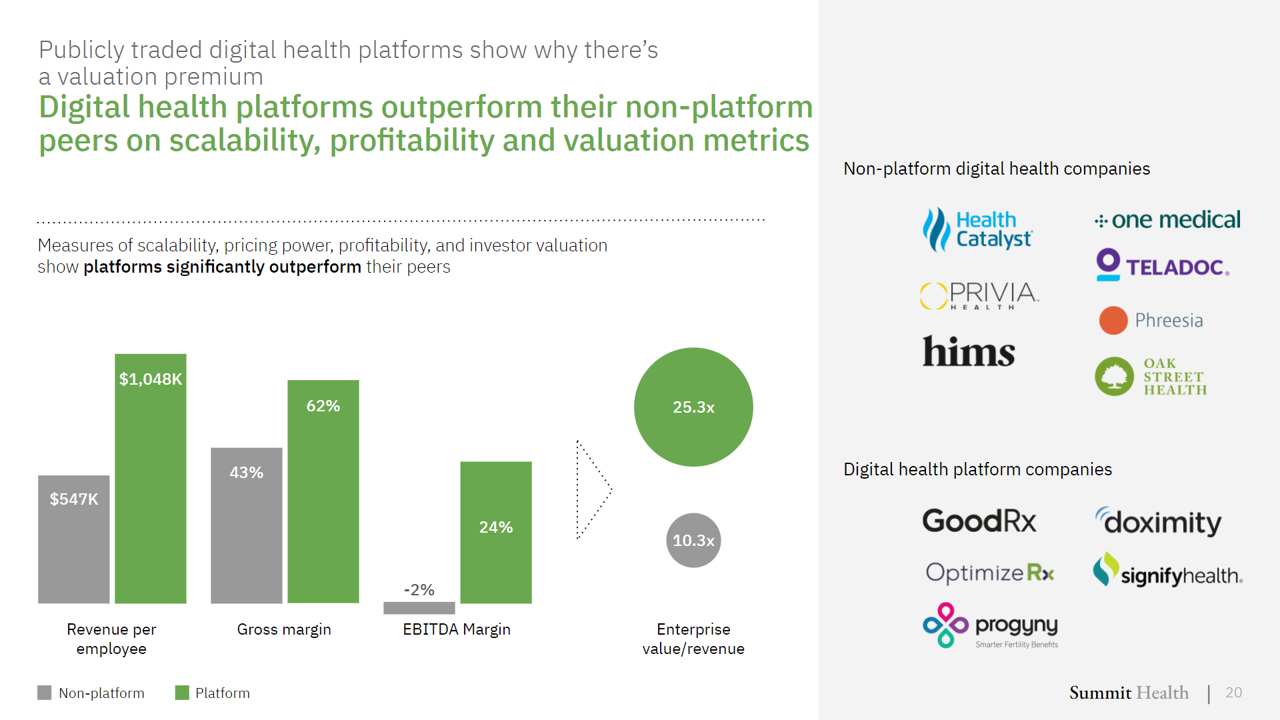

New analysis from Summit Health's suggests that digital health platforms command a higher valuation because there is now a demonstrated ability to deliver outsized returns to investors. The analysis (summarized in image below) shows that a group of publicly traded digital health platforms outperform their non-platform peers on metrics ranging from:

~2X revenue per employee, suggesting scalability

50% higher gross margin, suggesting significantly higher pricing power

Consistently higher (and positive) EBITDA margins

Accordingly, investors value platforms at 2.5X their non-platforms peers on an apples-to-apples basis

💡 Pro tip: “Network effects, and data network effects in healthcare specifically, need to be intentionally considered from day 1. Ask yourself fundamental questions: Will network effects be a second-order effect of your users using your technology? Will you or can you create positive and negative feedback loops to help assess data fidelity?” — Robin Shah, Co-founder and CEO, Thyme Care

Positioned for Growth and Preparing for the Future

Supported by an overwhelming amount of data, proven platform concepts, and an industry that increasingly depends on connectivity, interoperability, transparency and scalability, digital health platforms are showing up across the board as the preeminent business model, built for the future. For a more detailed analysis and critical insights on digital health platform growth and development, please request the full Platforms in Digital Health: 2021 Market Report, which includes:

Why platform business models are fundamentally different from non-platforms and the historical ways companies have created value;

How platforms are returning value at scale for investors;

Trends in digital health platforms in 2021 and the outsized impact platforms will have on the future of healthcare;

How the ‘flywheel’ of network effects creates value for the healthcare system and investors;

Number and average size of digital health platform investments;

VCs most active in digital health platform investments;

Perspectives from top digital health platform leaders (Innovaccer, Buoy, Redox, and Thyme Care).

🔥 Hot take: “Rather than go down the path of consolidation, a truer, more open marketplace would enable all of these specialized digital health companies to co-exist and compete.” — Andrew Le, CEO, Buoy Health

In addition, other digital health companies and investors included in the report include: Aledade, BrightInsight, CareRev, Cerner, Cigna, Ciitizen, Collective Health, Commure, CVS Health, DocStation, Doximity, evidation, GoodRx, Health Catalyst, Hims, Honor, IntelyCare, LetsGetChecked, Lyra, Maven, The Mayo Clinic Platform, McKesson, Oak Street Health, One Medical, OptimizeRx, Papa, Pearl Health, Pfizer, Phreesia, Privia Health, Progyny, Quest Diagnostics, Redox, Ribbon, Rightway, Seqster, Signify Health, Sondermind, Stellar Health, Teladoc, Truveta, Unite Us, Vericred, Vesta Healthcare, Wheel, Zocdoc, Zus Health and 1upHealth.

Healthcare technology investment dollars are flowing to a very specific location. Both platform developers and industry investors should take notice of these strong currents and make sure they’re swimming to the right shore.

Request a copy of the full Platforms in Digital Health: 2021 Market Report here, and please reach out to Summit Health founder Seth Joseph and Partner Nick Webber for more information or with any questions. You can also schedule a meeting directly with Nick here.