Why Digital Health Investors Should Rethink Their Strategy: The $1 Trillion Healthcare Platform TAM

Access novel platform research and analysis that will deepen your digital health investment strategy. Download the full Digital Health Investor Report: Most Attractive Platfrom Markets in Healthcare.

The most valuable companies in the world are platform businesses. Globally, 7 of the top 12 largest companies are platforms. In the private market, 60%-70% of unicorns are platform businesses. When compared to pure software or SaaS companies, platforms grow faster, reach greater profitability and produce unmatched shareholder value.

In digital health, platforms resoundingly outperform their pure software peers. They receive larger deal sizes, attain higher valuation premiums, and successfully grow and exit at higher rates. Further, healthcare platforms represent a combined $1 trillion TAM for investors.

Yet, in 2023, less than 15% of all digital health investment was placed in platform businesses; the rest in traditional software or SaaS companies. There is a massive missed opportunity here for investors.

“The very simplistic answer is if you look at the biggest companies in healthcare, they are network businesses, full stop.

— Julie Yoo, General Partner, a16z

The evidence is irrefutable: a platform strategy is a means of wealth creation unrivaled by any other business model. Yet most investors don’t prioritize platform investments accordingly. Digital health platforms should be an integral part of every healthcare investment strategy.

Unlocking the Value within Healthcare’s Web of Interactions

For most digital health SaaS companies, the multitude of stakeholders and interactions in healthcare creates added complexities and barriers to commercialization. For platform companies (and their investors) this web of interactions can drive tremendous innovation and unlock lucative investment opportunities–for those who can better facilitate these exchanges of value.

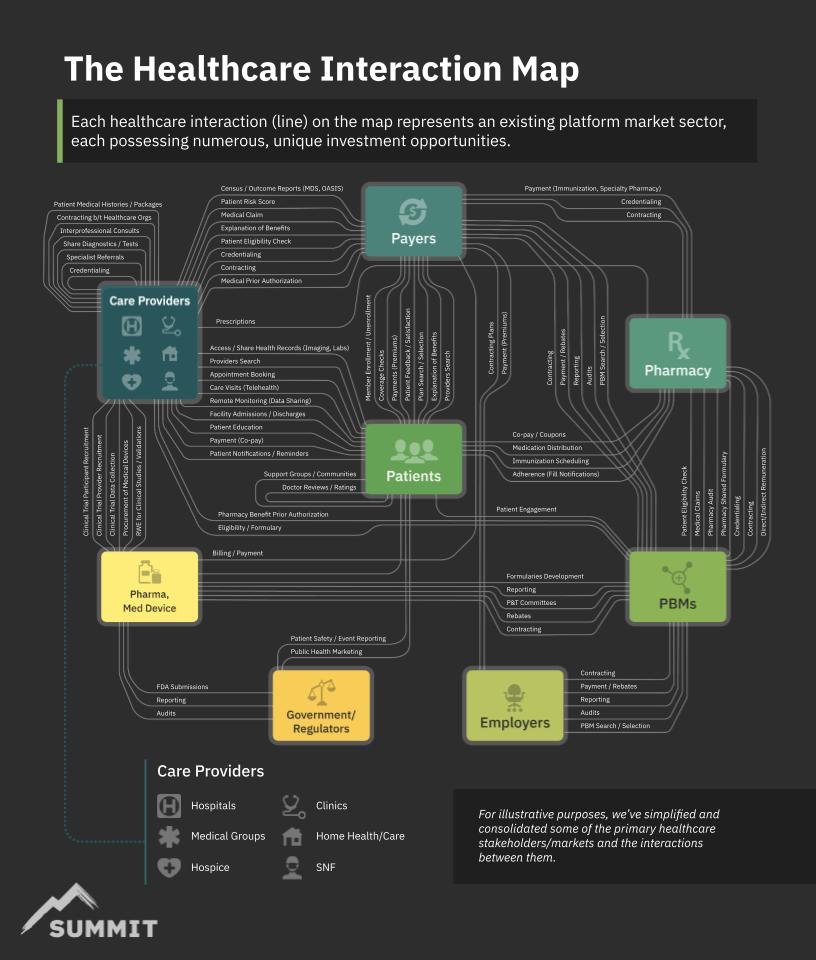

Each healthcare interaction (line) on the map below represents an existing platform market sector, each possessing numerous, unique investment opportunities.

The Healthcare Interaction Map (view larger image)

The healthcare interaction map depicts many of the high volume and/or high value interactions across the healthcare system. For illustrative purposes, we’ve simplified and consolidated some of the primary stakeholder groups (boxes) and interaction types (lines) between them.

Healthcare is Prime for a Platform Revolution

With over 90% of doctors using EMRs and consumers using smartphones, the challenge is no longer building software or apps for individuals. The opportunity now lies in connecting those individuals, and their systems, to facilitate new and more efficient interactions.

“Healthcare is naturally suited for network effects and platforms. There are just so many disconnected constituents. And so much disconnected data.”

— Carl Byers, Partner, F-Prime Capital

The delivery of healthcare is incredibly dependent on coordination, communication and collaboration amongst stakeholders. Medical claims, prescriptions, prior authorizations, referrals, care visits, medical data sharing, and so on. Without these interactions, healthcare would come to an absolute halt - as we got a small glimpse of with the recent Change Healthcare mayhem.

These interactions are the blood vessels coursing through the veins and arteries of the healthcare system, keeping it functioning and alive. For the platform companies that can facilitate these interactions with greater efficiency or reliability, there is tremendous value to be captured. For those who can use technology to create and facilitate new interactions between healthcare stakeholders, there is perhaps even greater value to be unlocked.

The Challenge (and Opportunity) with Platform Investing in Healthcare

Despite the promise of the healthcare platform market, investing in digital health platforms can be daunting. With delayed monetization and complex go-to-markets, it can be difficult for investors to confidently assess the strength and potential of a platform business.

Further, evaluating the size and value of a healthcare platform market can be challenging as platform businesses create value in the connections between various stakeholders across different (traditional) healthcare markets. This renders common market analysis, reports and expertise largely inappropriate or ineffective.

A new paradigm is required to guide platform investment strategy in healthcare.

The Digital Health Investor Report provides new data and research into the largest, most attractive platform market opportunities in healthcare to help investment firms develop and deepen their network effects investment strategy.

Request the Digital Health Investor Report: Most Attractive Platform Markets in Healthcare to dive deeper into the latest platform analysis and insights.

—

If you have any questions about the report or wish to explore our digitla health platfrom data, research and frameworks at greater length, please reach out to Summit Health Advisors.